REACHpay is a payment gateway directly from REACH that’s available to US-based nonprofits. We offer this PCI-compliant service through Stripe Connect.

We strongly encourage you to read through all REACHpay documentation prior to completing setup.

If you are a current REACH client – meaning, you have been using REACH with a different payment gateway and want to switch to REACHpay – please complete the following process:

1 – Email our Support team and request we enable the REACHpay option and EFT/ACH and/or multi-currency (both optional).

Note: ACH/EFT donations incur a $1 plus 1% transaction fee(rather than the 3.25% credit card fee) and multi-currency donations incur an additional 1% transaction fee.

2 – We will then email you back once you can begin setup.

Note: Once enabled, you will see REACHpay added as a menu item under Settings > Donation Settings > REACHpay and can begin setup.

3 – Complete your setup as outlined here.

4 – Once everything is completed, email us to schedule your transition date and time, as noted here.

5 – Test your donations as instructed here.

6 – Review Admin Notifications for donation disputes as noted here.

7 – Notify supporters of your new payment gateway, suggested wording provided here.

8 – Cancel previous payment gateway (when applicable) as noted here.

Setup Instructions

Step 1: Click on Settings > Donation Settings > REACHpay. A modal will pop-up with guided instructions for you to complete.

Important Note: The fields on the modal must be filled out by someone with significant control and management of your business.

Here is the information they will need to have on hand:

Please note additional information may be required. If so, please complete each field as requested.

- Employer Identification Number (EIN)

- Verification information that they personally represent the business:

- Legal name (used to verify identity)

- Email address

- Job title

- Date of birth

- Home address

- Phone number

- Last 4 digits of SSN (used to verify identity)

- Once finished, click Confirm.

Once the above information has been verified, you will then need to complete the following steps:

Step 2: Go to Settings > REACHpay > Officers tab, and add at least one additional officer to your account and designate them as a Representative or an Executive.

The Representative is the person authorized as the primary representative of the organization. This person has authority over the monetary funds within your organization and is typically your organization’s CFO, Treasurer, etc. This person will oversee donations and any potential donation disputes while using REACHpay as your payment gateway. This person may require additional personal identification to be uploaded, if so, our system will notify you.

The Executive is an executive or senior manager with significant management responsibility for your organization. This person is typically an Executive Director, President or a CEO.

For each, you will need their following personal details:

- Legal name (used to verify identity)

- Email address

- Job title

- Date of birth

- Phone

- Last 4 digits of SSN (used to verify identity)

Note: Once entered, some of this information cannot be edited. If these edits are required, please email our Support team.

Step 3: In the Payout Setup tab, add your organization’s banking information for your payouts and modify your payout schedule (optional).

For the Payout Setup, you will need the following banking details:

- Bank name

- Account Holder Name (a label for your reference)

- Account Holder Type

- Routing Number

- Account Number

Note: To edit this information, click Change Account.

By default, REACHpay’s payouts will be distributed daily on business days, with a payout speed of 2 business days. REACH will transfer funds to your banking account each business day. The funds transferred will be for the donations received two business days prior.

Your Payout Schedule will be noted on the REACHpay Overview tab.

To edit this information, go to the Payout Setup tab and click Change Payout Schedule. Next to Payout Frequency, you can choose Daily, Weekly or Monthly. Next to Payout Month Day, choose a number 1 – 31. This corresponds to the day of the month you wish to receive your payout.

Enabling Charges with REACHpay

As you go through the setup process, you will notice the Status area in the REACHpay Overview screen changes as each step is completed. Once your setup is complete, Charges and Payouts will both show as Enabled.

Once your setup is complete, email our Support team to schedule a transition date and time and let us know if you would like a list of donors with payment methods that did not transfer.

Once the transition is complete, you will start to use the REACHpay features in your account to track payouts instead of your current payment gateway. If you no longer have other payments processing through your previous payment gateway, you will want to decide whether to close that merchant account.

Notes:

- We will provide you with a migration date and time for the transition. Unless otherwise told, this requires no additional preparation on your part and you do not need to be present for the transition.

- We typically make the transition first thing in the morning, EST time, and will notify you once complete.

- For donors using a card as their payment method, this is a seamless transition and transfers the current payment methods automatically.

- US bank account (ACH/EFT) data cannot be transferred. If you choose to enable ACH/EFT with REACHpay, any donors using ACH/EFT for their payment method must manually link and authorize their US bank and personal account in the setup process. Refer to our REACHpay ACH/EFT articles for detailed information.

- The transfer process also checks for any payment methods that are no longer valid. Invalid cards do not get transferred as they are not considered a valid payment method.

- Current recurring donations will begin being charged via REACHpay with the donation settings you currently have set up.

- If you want to modify your transaction fees, you can do so by going to Settings > Donation Setup > Donation Form Settings.

- Note: Any recurring donations that were started prior to switching to REACHpay will continue being charged the same transaction fee that was set up at that time.

- To manually change each recurring donation to reset the transaction fee, go to the Sponsorship Supporter record, click Actions > Edit Sponsorship Supporter and confirm that the new transaction fee amount is reflected. Click Save Changes to set the new amount. To confirm that the amount has changed, view the Details page of the Recurring Donation.

Testing Donations using REACHpay

As with any new payment gateway, we always recommend you run some test donations once REACHpay is set up.

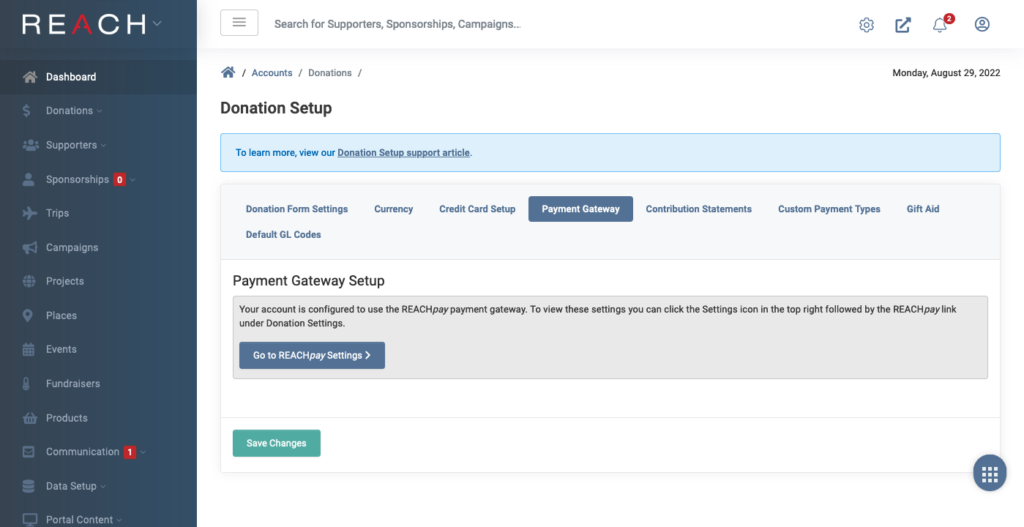

To begin, first go to Settings > Donation Setup > Payment Gateway tab.

If REACHpay is successfully configured, you will see a screen as shown here. We then recommend running some test donations as both an Admin and as a Supporter.

To test from your Admin Console, go to Donations > + New Donation > complete an Online donation . Be sure to check that the donation was successful.

To test as a Supporter, go to your public REACH donation form, and add a donation. We then recommend you review the donation in your Admin Console to ensure it is complete.

Review Admin Notifications for Donation Disputes

Should a donation be disputed, your organization’s account email is automatically sent an email notification that includes a link to review the donation details.

We recommend that any other necessary admins also opt-in to Donation Disputes and Early Fraud Warning email notifications by following these instructions.

The email notification will list the reason for the dispute and the steps needed to take to resolve the dispute. Learn more on How Disputes Work.

Notify Supporters of New Payment Gateway

We recommend notifying your supporters of your switch to a new payment gateway.

You can email all of your supporters directly within REACH. Refer to our Emails article to learn more.

Please note that if you enable ACH/EFT with REACHpay, any previous ACH/EFT payments are not transferred. Your supporters will need to manually link and authorize their US bank account and personal account.

To limit any questions or concerns, we recommend sending the following message:

We will be switching payment gateways for our online giving platform to REACHpay. This switch will result in lower transaction fees for online giving and the opportunity for you to give using Apple Pay and Google Pay.

When using REACHpay, banks and card issuers have the final say in how transactions are listed on statements. Some donors will see your organization’s name, while some may only see REACH listed on their credit card statement.

During the transition process to REACHpay, as it would be with any transition to another payment gateway, there is also a verification process that tests whether the payment method we have on file for you is still valid. Some card companies will show this as a pending transaction on card statements. For example, the transaction could show as a $1 pending capture from REACHpay or REACH on your banking card statement. In these occurrences, there is no money charged and the pending transaction should disappear from the statement within a few days.

Cancel Previous Payment Gateway

Once you make the switch to REACHpay, it is up to your organization to cancel your previous gateway when deemed appropriate.

While there will not be a need to maintain another payment gateway account once all supporter payment methods are transferred, it is up to your organization to decide when you are free and clear of everything tied to your previous payment gateway account. Once that is confirmed by your organization, you can cancel your previous gateway’s account on your own.

Let’s Get Social