REACHpay is a payment gateway directly from REACH! We offer this PCI-compliant service through Stripe Connect.

Payouts

By default, REACHpay’s payouts will be distributed daily on business days, with a payout speed of 2 business days. REACH will transfer funds to your banking account each business day. The funds transferred will be for the donations received two business days prior.

Your Payout Schedule will be noted on the REACHpay Overview tab.

To edit this information, go to the Payout Setup tab and click Change Payout Schedule. Next to Payout Frequency, you can choose Daily, Weekly or Monthly. Next to Payout Month Day, choose a number 1 – 31. This corresponds to the day of the month you wish to receive your payout.

REACHpay includes a single transaction transaction fee. Your organization’s transaction fee is noted under the Information section on each REACHpay page. This transaction fee is taken from each transaction before the payout.

US bank account (ACH/EFT) incur a $1 plus 1% transaction fee. Funds will be withdrawn within 1-3 business days from the supporter’s US bank account. Please allow 2-4 business days for the donation to be marked as complete within REACH.

Note: Bank statements will display the total amount of the donation. The Payout view will display the breakdown by donation. You can also run a Payout Reconciliation Report to view a summary of the payout line items from REACHpay and their associated donations. The Report displays fields for both the original transaction amount and the the transaction fees that have been taken out.

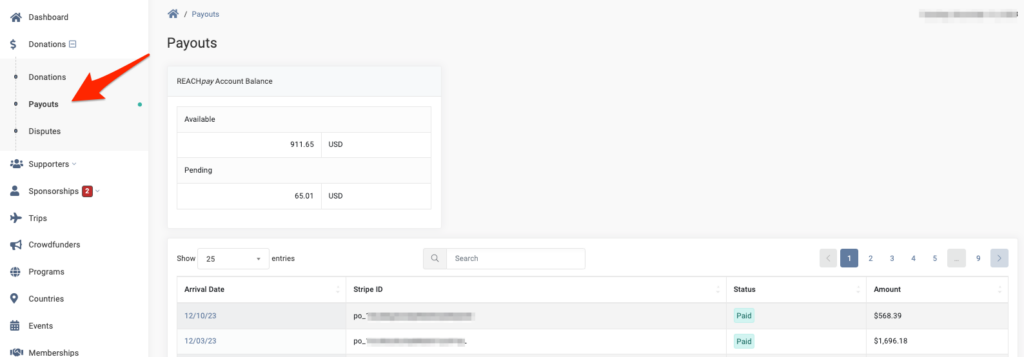

Once you begin to receive donations, you can review your Payouts by going to Donations > Payouts.

Payout data will include a table listing the Arrival Date, Stripe ID, Status and Amount of your payouts.

Note: You can set how many entries to show and search payouts by typing in any of the included fields.

REACHpay Account Balances

Your REACHpay Account Balance that includes the Available amount and the Pending amount will be shown at the top of the Payouts page.

Some actions, such as refunds and chargebacks, create negative transactions in a REACHpay account. If at all possible, REACHpay automatically offsets negative transactions against future payout funds to ensure a positive REACHpay balance.

If a REACHpay account balance is negative, REACHpay will debit your external account on file.

REACHpay will attempt to debit up to the maximum attempts allowed. If all attempts fail, REACHpay will pause payouts to and debits from the external account until the external account on file is updated or charge the balance due to your card on file used for REACH monthly invoicing.

Deposits

On your banking statements, deposits will include the date, REACHpay and the total amount.

Here’s an example:

Let’s Get Social