REACH provides a way to keep track of recurring donations through the past due calculation.

Recurring donations are considered Past Due one month after a failed donation.

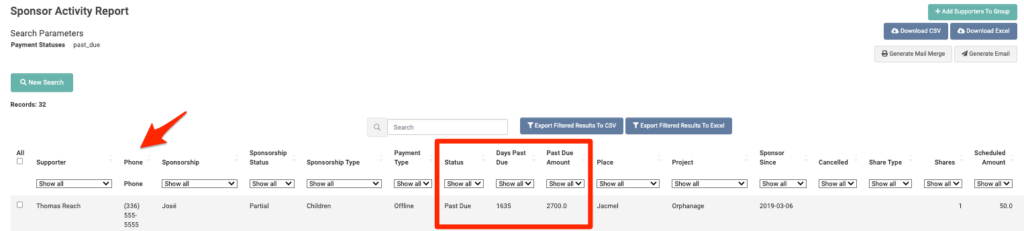

The past due listing on the dashboard is a summary from the past due check that runs weekly on Sundays. If you need a up-to-date report of past due more current than weekly, you can use the Sponsors Activity report, select “Past Due” on the “Payment Status” drop down, and it will give you a list of only the sponsorship supporters that are currently past due.

Alerting of Past Due

Important Notes:

When a sponsorship or other recurring donation is past due, the system will provide alerts in a number of ways – from the Dashboard, from Sponsorships marked in red in the Sponsorships module, from an offline Sponsorship Payment Reminder email notification, and from the Sponsorship-Supporter record. An admin user can then address the past due payment as needed.

To review your Sponsorship Account Rules, go to Settings > Account Rules > Sponsorships tab. From here, you can choose which Admin to notify when a sponsorship becomes past due. You also have the option to display an alert directly to your sponsors notifying them that they have a past due sponsorship payment when they are logged into their Donor Portal. Refer to our Catch Up Alert in Donor Portal article to learn more.

How Past Due is Tracked

Legacy Sponsorships are not tracked for Past Due amounts.

Information on how much a supporter has given and what amount is expected to date is shown in the Sponsorship-Supporter record.

The Past Due Amount calculation uses the Date the sponsorship started in REACH, the Cost per Share, and the Tracked Given with Skipped.

Date for Online Sponsorships: The date used to calculate is the Payment Start Date, which is the date when the Online recurring sponsorship started (or when an Offline or Legacy sponsorship is Converted to Online). Note: This date can be edited, but we recommend this only be done for special instances, as it will effect the Past Due calculation for the sponsorship, according to Tracked Giving, as explained below.

Date for Offline Sponsorship: The date used is the Sponsor Since Date. This date can be edited by an Admin.

Cost per Share: The cost per share of a sponsorship is based on the share amount set in Sponsorship Type and is multiplied by the number of shares selected by the supporter. Note: If an admin edits the amount per share a supporter is paying, the original cost per share set for the Sponsorship Type will still be used for the past due calculation.

Tracked Given with Skipped: This is the total amount given since the Payment Start Date (Online) or the Sponsor Since Date (Offline), plus any donations that were skipped (marked as current by an admin). Tracked Given does not include donation history prior to the date the sponsorship started in REACH.

Payments are marked past due one month after the due date. For example, if a supporter started a sponsorship on January 5th, with a second successful donation on February 5th, but missed the March 5th payment, the supporter is not considered past due until April 5th.

Reporting on Past Due Sponsors

If you’d like to generate a report of Past Due Sponsors, you can go to:

- Reports > Sponsors

- Filter by date, if desired

- Note: When filtering by date, the report will pull only sponsors who started sponsoring within that date range. If you want to see ALL past due sponsors, do not enter dates in the Date Range.

- Next to Payment Status > click Past Due

- Use Select Columns to Display to show any additional information you may need.

- For example, many clients will check Phone so the supporter’s phone number is generated on the Report.

- Click Search

Your generated Sponsors Activity Report will display as follows, listing all of your Past Due information.

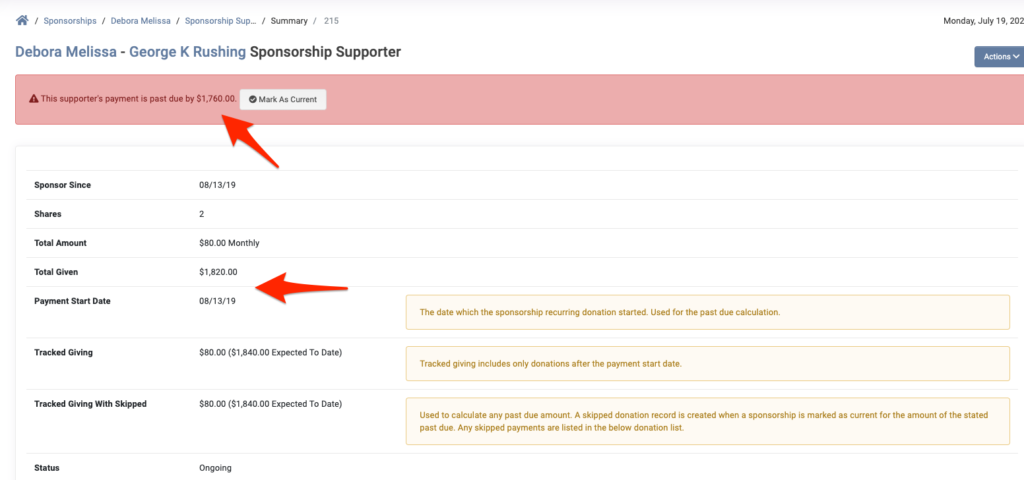

Online Sponsorship Example

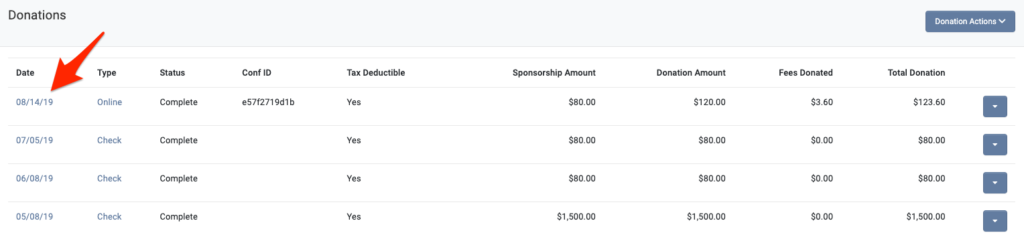

George was paying by check for his sponsorship, which was then converted to online on 8/13/2019, making it the Payment Start Date. He has given $1,820 (Total Given) toward the sponsorship. According to the Payment Start Date and the Cost per Share, he should be giving $80/month, for a total of $1,840 to date.

As shown below, his only payment since his Payment Start Date was $80 on 08/14/2019. George’s account is now Past Due by $1,760.00.

$1,840.00 Expected to Date – $80 Tracked Giving, i.e. given since Payment Start Date = $1,760.00 Past Due.

In order to include the sponsorship payments given before converting to online, an admin could then Mark As Current by clicking Donation Actions > Mark As Current.

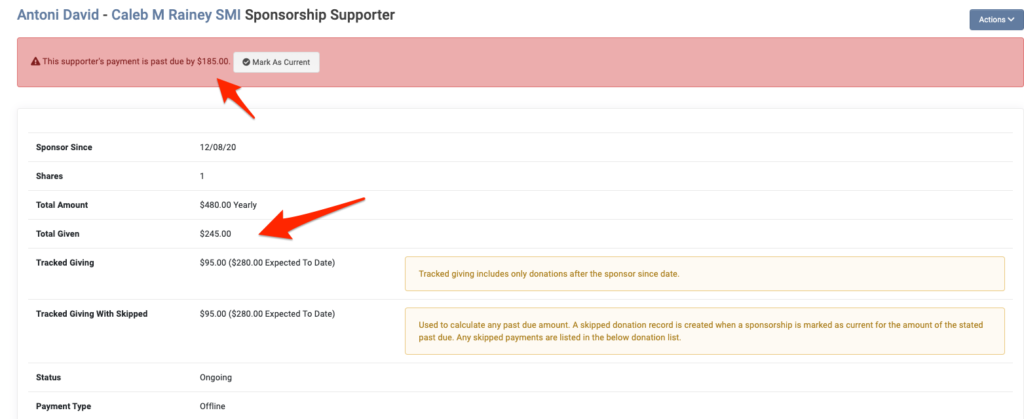

Offline Sponsorship Example

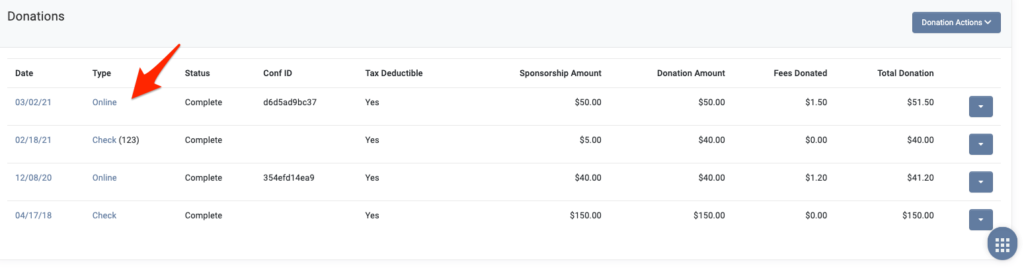

In this example, Caleb has given $245 total toward the sponsorship, but only $95 has been given since 12/08/2020, his Sponsor Since date.

According to the $480.00 yearly cost per share, $280.00 is expected by this point in time. Since he has only given $95.00 and not made a payment after 03/02/2021, and the first payment is not counted, Caleb’s account is marked Past Due by $185.00.

$280.00 – $95.00 = $185.00

Since this is an offline sponsorship, an admin has the option to click Actions > Edit Sponsorship Supporter and change the Sponsor Since date to include the first payment.

See our article on Supporter Notifications to learn how to set up automatic messages to Offline sponsors when their payment is past due.

Yearly Donations

In regards to yearly donations such as this one, if a sponsorship is marked as Yearly, the calculation will work the same way as other past due payments – the system will look at the Sponsor Since Date and calculate monthly what should have been received to date. If a yearly payment has been made and recorded, the system will mark the sponsorship as past due only when the total given (yearly total) is less than what is expected monthly.

For online yearly recurring donations, Supporters are automatically notified by REACH seven days before the donation is processed.

Watch Webinar

Watch our All About Past Due and Recurring Donations Webinar to learn about these processes in REACH. We detailed exactly what they mean, how to reconcile past due donations and provide your many options for recurring donations.

What We Covered:

- How to Correctly Set Up a Sponsorship for a Supporter

- How Past Due is Tracked

- How to Adjust Number of Sponsorship Shares

- How to Add a Sponsorship to an Existing Sponsorship

- Sponsorship Account Rules

- Recurring Donation Account Rules

- Offline Sponsorship Past Due Notification

- Donor Portal Past Due Indicator and Catch Up Alert

Let’s Get Social